Connect

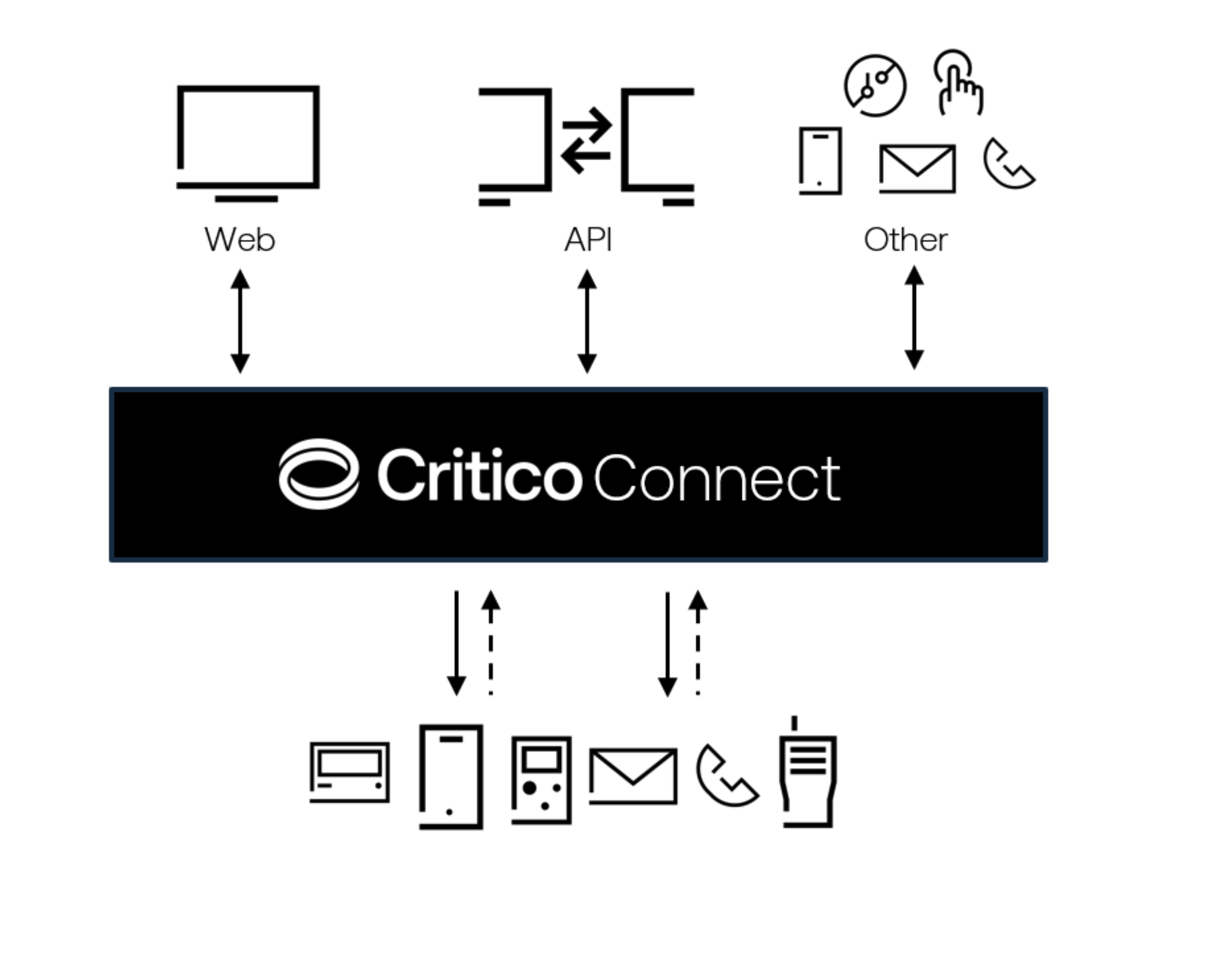

Connect brings the power of multi-channel messaging and alerting to you, underpinned by Critico’s secure and resilient Multi-Channel Messaging Platform (MCMP). From simple notifications to powerful multi-channel broadcasts across text, email, app, paging and voice, Critico Connect helps thousands of customers across Government, blue-light and corporate companies communicate more effectively, improve operational response and drive customer engagement.

Connect Desktop puts the power of mobile messaging at your fingertips allowing you to initiate individual, group and bulk file messages and alerts. Admin features allow you to manage and control your messaging service and access real-time reporting on delivery and responses.

Connect’s API Gateway provides a rich suite of connectivity options to support automated and integrated messaging to/from third party systems. For example, the majority of blue-light control room software systems already integrate with our API gateway for fast and reliable mobilisation messages, and to receive responses and updates from the field.

Alternate Inputs – Critico support a range of input options to help our services fit with operational processes. SmartGroup/Filter messages can be triggered via app, email, SMS, alarm systems and even via our 24-hour call-centre.

Safe & Secure

Data security is at the heart of Connect. Our services are ISO27001 accredited and Cyber Essential certified. All transactions are TLS encrypted in transit.

Flexibility

Whether it’s automated customer notifications from your CRM system, alerting IT teams to system alarms, or mobilising incident response team from your mobile when your office is evacuated Connect can fit with your workflow and operational processes.

Multi-Channel

Connect is multi-channel by design supporting mix and match alerting across app, SMS, paging, email, landline, and delivering high capacity, high-resilience throughput to national networks and local systems.

Integration & APIs

Connect offers a range of API methods to enable integration with your business systems, whether its blue-light mobilisations, system monitoring alarm notifications, or customer appointment reminders Connect allow your to automate real-time alerting.

Group Broadcast

Mobilising engineer teams or coordinating BCDR incident demands quick and efficient broadcast. Our multi-channel SmartGroups and SmartFilters allow you to manage and control distribution of group messages across individuals, teams and devices via defined lists or rule-based (e.g. send to engineers with current status of available).

Reporting & Control

Connect Desktop provides a secure admin web-portal through which you can manage and configure your services, together with real-time reporting of messages, delivery and responses – keeping you in the picture and in control. User accounts provide a quick and easy way to send and receive messages from the desktop.

Real-time Feedback

Knowing a message has been delivered, knowing a crew has been mobilised, knowing a volunteer is available or where the nearest engineer is, all help you manage resources and responses more effectively. Connect assimilates acknowledgement and responses in real-time, presenting them to your desktop or pushed directly into your own software systems.

CONNECT DESKTOP | Features

Freetext or Template Messaging

Contacts Database

Including custom fields to suit you

Bulk Upload/Send

With managed throughput rates and times

Merge Templates

Upload and auto-merge data file with message templates

SmartGroups

Multi-channel broadcast groups that you control

SmartFilters

Rule/context-based broadcasts (e.g. available engineers)

Divert Profiles

Define manage message diverts for shifts/rosters

Campaign Manager

For interactive 2-way SMS campaigns

Real-time Message Log

Includes delivery confirmation and responses

Auto-Forward

Push inbound messages where you want

Reporting/Audit

View and export message logs

Account Types

Admin and user roles